The Chinese government has criticised a US move to expand the powers of its foreign investment watchdog.

The government is worried that the move means the US will use national security concerns unfairly in order to restrict Chinese investments.

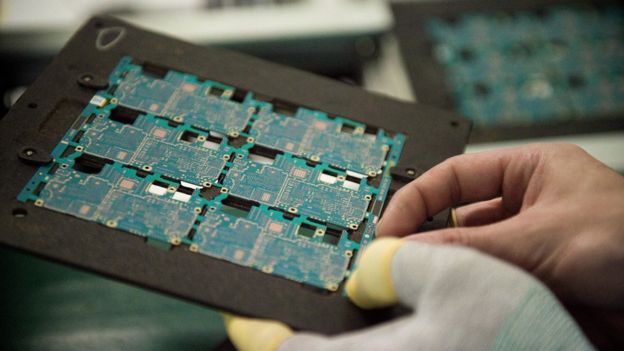

The new investment rules will target Chinese companies investing in technology industries in the US.

It comes as the US and China both prepare to slap tariffs on $34bn worth of each others' goods.

US President Donald Trump has said he supports legislation that would expand the powers of the Committee on Foreign Investment in the United States (CFIUS).

CFIUS is an inter-agency body which scrutinizes the national security implications of business deals that would result in foreign ownership of US companies.

It can make recommendations to the president, who can stop a deal from going though, although in practice a negative CFIUS finding alone is sometimes enough to kill off a deal.

"I have concluded that such legislation will provide additional tools to combat the predatory investment practices that threaten our critical technology leadership, national security, and future economic prosperity," Mr Trump said in a statement.

The legislation would expand the role of CFIUS, allowing it to stop a deal if it would pose a threat to America's technological edge.

Intellectual property is a key sticking point in the trade tensions between US and China, with the US accusing China of stealing its technology.

China's commerce ministry says it objects to the US using national security as an excuse to tighten the rules for Chinese companies in the US.

"China will closely monitor the legislation process and evaluate its potential impact on Chinese companies," said Chinese commerce ministry spokesman Gao Feng.

China is a major investor in the US, and it stands to lose from tighter foreign investment rules.

The Chinese government's economic plans have a strong focus on technological advancement.

One way to acquire better technology is to invest in foreign companies that already have it.

CFIUS has knocked back a string of proposed Chinese acquisitions of US companies over the past year.

The new legislation is likely to be an additional hurdle.

Chinese investment in the US has taken a big hit since Donald Trump became president.

Figures from the Rhodium Group found that the value of deals fell by more than 90% in 2017.

The American Enterprise Institute (AEI), a conservative US think-tank, found that China invested $24.2bn across all sectors in the US last year - a huge drop from 2016, but still the second highest on record.

Chinese companies have invested about $21.6bn in US technology businesses since 2007, according to the AEI.

The latest move comes amid continued trade tensions between the world's two largest economies.

Earlier in the week, reports suggested that the US might target investments in the America by any company with more than 25% Chinese ownership.

It appears that this plan has been abandoned in favour of an expanded role for CFIUS.

But even if the US has backed off on investment rules, it looks set to move ahead with tariffs.

The US will impose tariffs of 25% on $34bn worth of Chinese goods starting from 6 July, with an additional $16bn potentially to follow.

China has promised matching tariffs in retaliation.