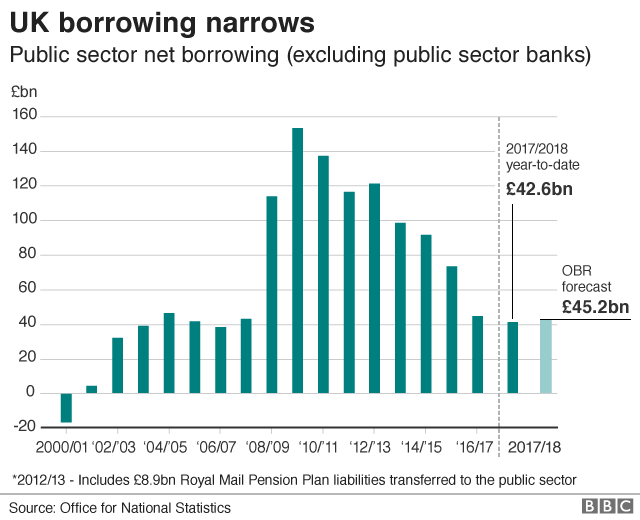

Government borrowing has fallen to its lowest annual level in 11 years, according to the latest official figures.

Borrowing fell by £3.5bn to £42.6bn in the 2017-18 financial year, the Office for National Statistics (ONS) said.

That was below the estimate of £45.2bn produced by the independent Office for Budget Responsibility last month.

Borrowing narrowed to 2.1% of gross domestic product (GDP) last year, down from 10% in 2010.

However, total public debt as a percentage of GDP edged up to 86.3%, up from 85.3% the year before. In cash terms it stands at £1.798 trillion.

The figures are the first provisional estimates of the last financial year. The ONS stressed they would be revised as more data becomes available.

March's deficit was £1.3bn, well below a forecast for a gap of £3.25bn.

The borrowing figure does not include the amount spent on supporting the state-owned banks.

Mr Hammond has kept the broad aim of the previous chancellor, George Osborne, of reducing the gap between spending and borrowing, although he has eased off on the pace of cut-backs.

Mr Hammond said: "Thanks to the hard work of the British people, borrowing is the lowest in over a decade. Our economy is at a turning point with debt starting to fall and people's wages rising, as we build an economy that truly works for everyone."

Philip Hammond welcomed the news - his target is to eliminate the deficit by the middle of the next decade.

But the chancellor also knows that a lower deficit creates its own challenges.

And a test for the type of politician he is.

The figures will increase calls for the Treasury to signal a significant increase in public spending at the Autumn Budget - with the NHS in England and Wales the priority.

That is something Mr Hammond signalled he would do at the Spring Statement last month, if the deficit was below target.

Which it now is.

But many in the Treasury believe that now is not the time to turn on the spending taps and that the focus should remain on reducing the deficit.

Particularly while the economic headwinds of a sluggish economy and possible Brexit risk remain.

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the figures did not necessarily indicate an improving economy: "Rapidly falling public borrowing continues to reflect sharp falls in spending, rather than a reviving economy.

"Lower borrowing in March than last year primarily reflected a £1.0bn decline in interest payments and a £1.4bn reduction in Local Authority borrowing. Both these expenditure components are volatile and tell us little about the underlying health of the economy."

John Hawksworth, chief economist at PwC, said: "The key challenge facing the chancellor in his Budget in November will be how to trade-off growing political pressures to ease austerity against his desire to get the debt ratio down as far as possible.

"The undershoot in the deficit this year has given the chancellor a little more wriggle room, but it does not alter the fundamental strategic choice he will need to make in November."