Apple is once again the biggest selling producer of wearables after its third-generation Apple Watch, released in September, helped it pip China’s Xiaomi to the post.

The new device, Apple’s first that connects to the internet without being tethered to a smartphone, took the U.S. mobile giant to 3.9 million shipments in the recent Q3 2017, according to new data from Canalys. The firm estimates that the gen-three version accounted for just 800,000 shipments, due to supply issues, which bodes well for Apple coming into the lucrative holiday season.

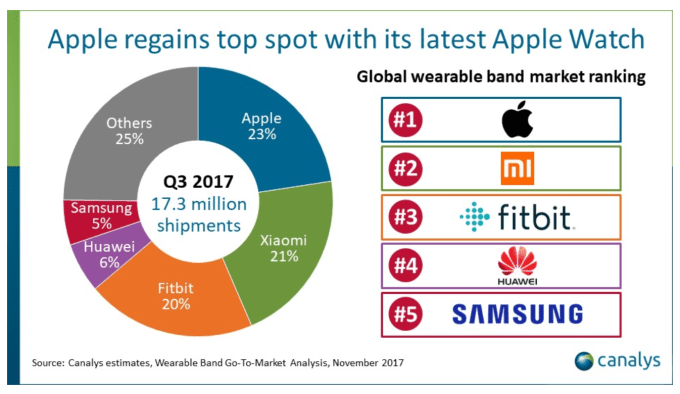

That figure was a big jump on 2.8 million shipments one year previous. It also gave Apple 23 percent of the market, putting it fractionally ahead of the 21 percent for Xiaomi, the Chinese firm that was briefly top of the industry for the first time in the previous quarter.

Apple’s wearable division has enjoyed something of a renaissance this year, grabbing the top spot in Q1 for overall wearables the first time since Q3 2015. CEO Tim Cook said in Apple’s most recent earnings report that Watch sales were up by 50 percent for the third consecutive quarter thanks to a focus on health services.

As for the others: Fitbit took third in Q3 2017 for 20 percent, while phone makers Huawei (six percent) and Samsung (five percent) were some way behind in rounding out the top five. In proof of considerable fragmentation within the industry, ‘other brands’ accounted for a dominant 25 percent, according to Canalys’ figures.

Q3 is traditionally the year’s weakest period for wearable sales — since many consumer hold off on large ticket items until the Christmas period — but Canalys said the top vendors were all up on the previous quarter. Overall, however, the industry was down three percents — primarily due to lackluster interest in basic fitness bands.

The research firm took that as a positive sign of the potential for smartwatches now that Apple, the most visible player, is offering LTE versions.

One caveat to that, however, is that the Apple Watch 3 does not ship with LTE support in China — a key market for the U.S. firm — due to apparent security concerns. That’s likely to temper some of the positivity that it has seen in the Middle Kingdom, where the new iPhone 8 and iPhone X have returned its business to growth after a challenging 18-month period.