Provisional production figures available to the Business and Financial Times have indicated that in 2015 gross premium income earned by the top three life insurance companies upstaged its non-life counterparts. Although the figures are unaudited, the gross premiums earned by Enterprise Life, SIC Life and Star Life made these companies top earners of premium income in the industry.

Most analysts foresee the life sector as the future of the risk bearing industry in Ghana. Enterprise Life within its short period of operation is now the number one premium earner in the Ghana Insurance Industry.

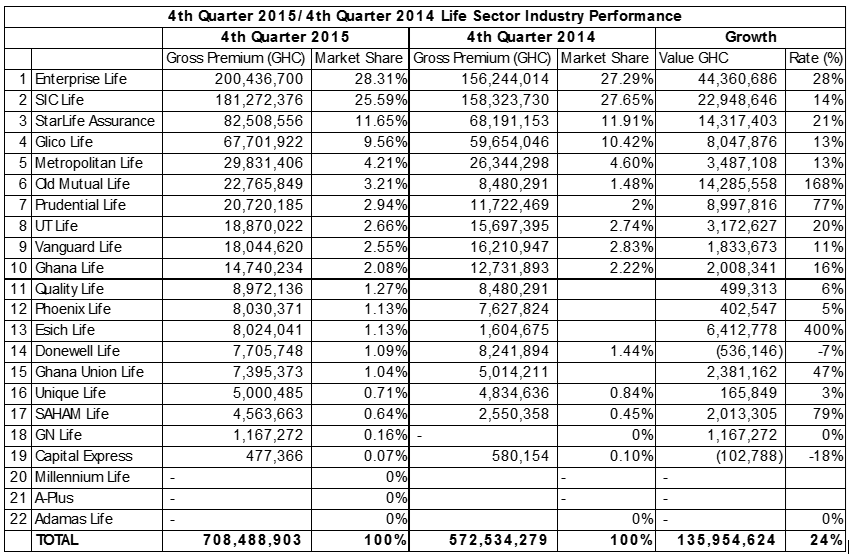

In the 2015 accounting year, provisional figures proved that the company controlled about 28.31% market share. Gross premium income (GPI) grew from GHC 156.244 million in 2014 to GHC 200.436 million in 2015, with the change in income of about GHC 44.360 million representing 28% growth.

Insurance industry analysts predict a brighter future for the company’s growth from 2017. Until 2014 SIC Life was the number-one premium earner in the country. SIC Life that year topped the Life and Non-Life sector’s income by earning GHC 158.323 million.

That year SIC controlled a market share of 27.65%. Surprisingly, in 2015 SIC Life was downed to the number 2 position by Enterprise Life by a margin of about GHC 19.154 million.

“We saw a change in the top position coming since 2014, when Enterprise Life narrowed the margin in premium income. That year the difference was less than three million Ghana cedis,” say some industry watchers.

Star Life has gradually moved itself to upstage GLICO Life, which has moved to fourth position. Star Life grossed income of about GHC 82.50 million in 2015 with a market share of 11.65% to make it the third-largest income earner in the industry