Growth in the UK's economy has slowed as car sales fell and the manufacturing sector stalled, the Office for National Statistics (ONS) has said.

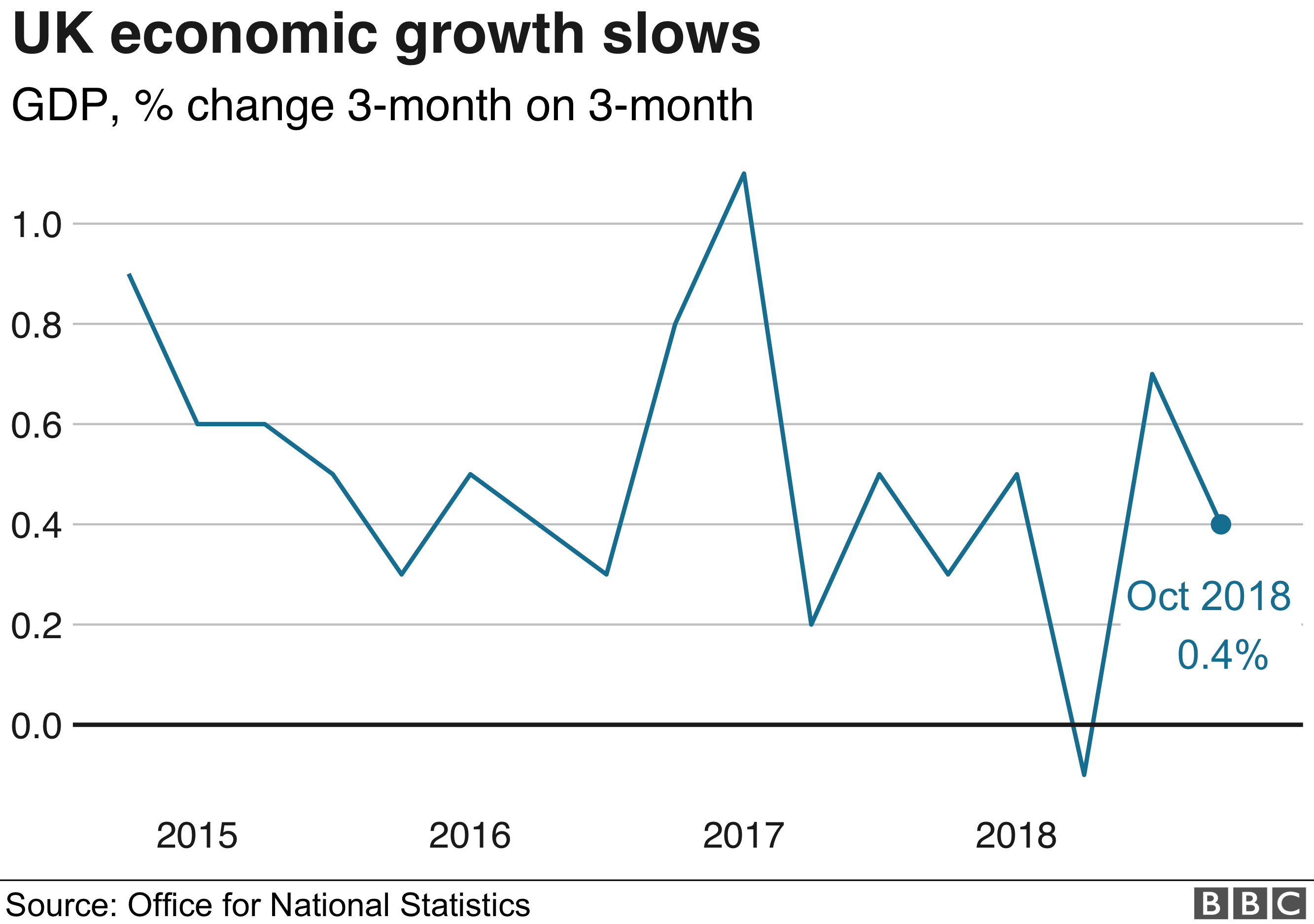

The economy grew by 0.4% in the three months to October, slower than the 0.6% in the three months to September.

The UK's trade deficit also widened as imports grew faster than exports in October.

Economists expect growth to slow in the last three months of the year.

The latest three-month growth figure follows a stronger-than-expected set of data for the three months to September, when the economy grew at its fastest pace since late 2016 buoyed by consumers spending in the warm weather.

"GDP growth slowed going into the autumn after a strong summer, with a softening in services sector growth mainly due to a fall in car sales," said Rob Kent-Smith, head of national accounts at the ONS. "This was offset by a strong showing from IT and accountancy."

"Manufacturing saw no growth at all in the latest three months, mainly due to a decline in the often-erratic pharmaceutical industry," he added.

"Construction, while slowing slightly, continued its recent solid performance with growth in housebuilding and infrastructure."

The services sector grew by 0.3% on the three-month rolling measure - the lowest since the three months to April 2018.

The sector's performance is closely watched as it makes up 80% of the economy.

There were some negative signs in the latest economic growth figures, but on the whole they were benign, with services such as accountancy driving modest economic growth.

But here we meet the frustration of lagging economic indicators.

If we want to know what effect the upheaval at Westminster over the Brexit withdrawal agreement has had, the more recent indicators tell a less benign story.

In November, retail sales grew by 0.5 per cent overall (including online). But if you exclude food they were flat, and sales in shops were down.

Similarly, the leading indicator of business activity, the purchasing managers' index which tracks buying decisions by business executives, recorded its worst reading in the services sector since the month after the referendum, July 2016.

Activity expanded, but only just.

Unfortunately we won't know the effect of Theresa May's troubles on November's economic growth (GDP) until January, by which time it will be far too late to influence decision making.

GDP grew by 0.1% in October - after being flat in both September and August.

In October, the first month of the last quarter of the year, the services sector was the only major part of the economy to expand.

Industrial production fell 0.6%, with manufacturing output down 0.9%. Output in the construction industry fell 0.2%.

Chris Williamson, chief business economist at IHS Markit, said the latest growth figures "come on the heels of more up-to-date survey evidence which suggests the economy is approaching stall speed and could even contract as we move into 2019 unless demand revives".

In October, the UK imported more than it exported despite the weakness in the pound.

The trade deficit widened to £3.1bn in October, the ONS said, as imports increased by £3.6bn, faster than the amount exported, which rose by £1.9bn.

The ONS also revised the trade data for September, which now shows a deficit of £2.3bn compared with £0.1bn.

"The widening in the UK's trade deficit is a concern and reflects a sharp rise in goods imports," said Suren Thiru, head of economics at the British Chambers of Commerce (BCC).

"Trading conditions for UK exporters are deteriorating amid moderating global growth and uncertainty over Brexit. Businesses continue to report that the persistent weakness in sterling is hurting as much as its helping, with the weakening currency raising input costs."

With October marking the start of the fourth quarter, economists said the economy's progress in remaining months of the year could be determined by Brexit negotiations.

Mr Williamson said: "The outlook for growth... very much depends on Brexit developments over the coming days, weeks and months, and the surrounding uncertainty makes forecasting extremely difficult.

"However, what's clearly evident is that the widely-expected slowing of the economy in the lead-up to the UK's separation from the EU is now upon us, leaving the big question of whether the economy will bounce back alongside a smooth Brexit process or slide into decline," he said.

Yael Selfin, chief economist at KPMG UK, said that surveys of the services sector were also showing weak growth which do "not augur well" for the last quarter of the year.

Capital Economics is forecasting annual GDP growth of 1.3% for this year - the lowest since the financial crisis.