Energy giant Royal Dutch Shell is to set carbon emission targets and link them to its executive pay.

The Anglo-Dutch company has made the move after pressure from investors, led by asset manager Robeco and the Church of England Pensions Board.

The groups said they believed "climate change to be one of the greatest systemic risks facing society today".

Shell will link energy transition and long-term pay, subject to a shareholder vote in 2020.

The firm is still in talks with investors over the precise figures over carbon targets and what percentage of pay might be affected, but it is estimated that as many as 1,300 high-level employees could be employed.

David Cumming of Aviva Investors told the BBC: "This is evidence of the growing power of what they call ESG - environmental, social and governance - investing.

"Investors are increasingly concerned over environmental and social metrics like carbon emissions.... and encouraging moves like the one seen today."

He said other oil firms would be forced to follow Shell's example.

"We will see more of this going forward," said Mr Cumming. "The pressure is on for that, they will come round to statutory [carbon] metrics."

Shorter-term targets

Shell aims to set three- to five-year targets every year which will include specific net carbon footprint targets.

Last year, shareholders criticised Shell for last year setting long-term "ambitions" to halve its emissions of carbon dioxide by 2050, which lacked binding targets.

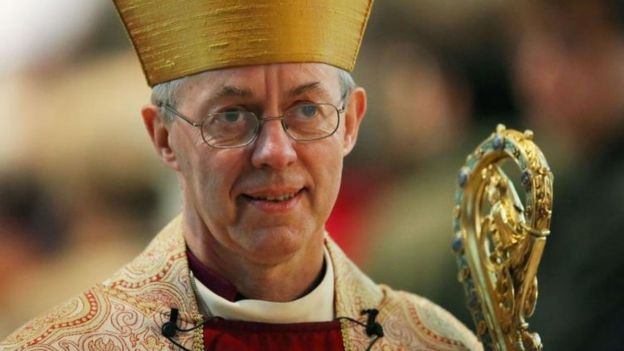

The Archbishop of Canterbury, Justin Welby, said he was "delighted" with the move

Shell has now signed a joint statement with a group of 310 investors with more than $32 trillion (£25tn) of assets under management, dubbed Climate Action 100+.

"We are taking important steps towards turning our Net Carbon Footprint ambition into reality by setting shorter-term targets," said Shell boss Ben van Beurden.

It comes as governments meet in Poland for a conference hosted by the United Nations COP24 which will lay out a "rule book" to implement a 2015 climate accord.

According to Adam Matthews, director of ethics and engagement for the Church of England pensions board, the Shell move "sets a benchmark for the rest of the oil and gas sector".

He also said it showed "the benefit of engagement - aligning institutional investors' long-term interests with Shell's desire to be at the forefront of the energy transition".

The Archbishop of Canterbury, Justin Welby, added: "As governments meet at the United Nations climate negotiations in Poland, I am delighted to see a unique announcement on climate change between investors and one of the largest companies in the world - Royal Dutch Shell.

"I am pleased that the Church of England Pensions Board has worked in collaboration with other investors... and with the management of Shell."